New GST Registration in Delhi

The full name of GST is Goods and Services Tax (GST). This is being implemented in lieu of more than 20 indirect taxes imposed by the Center and the States. Since this has been implemented, So many small businesses have been enrolled.Therefore We decided that we will help those people who want to start their own business or Startup companies. We are offering GST Registration in Delhi or Pan India Just ₹ 499 – Call Now ? +91 9971764268

We are having our satisfied clients in Delhi, Faridabad, Gurgaon, Haryana, Kanpur, Lucknow, Noida, Meerut, Agra, Bareilly, Uttar Pradesh, e.t.c. PAN India

Benefits of Online GST Registration

.

✓ In GST regime it is very easy for the market to sell their product because there is no bias and buyer can purchase from any registered vendor.

✓ Gst means goods and simple tax so it means input will be available for all purchases and expense. So we are there to help our clients in attaining that.

✓ The one who legally follow’s the market rules and regulation are successful now a day and we are there to help our clients in that. So the opportunity is at your door to comply with GST rules with us.

New GST Registration For e-Commerce or Online Business

.

Nowadays in the digital era, all the digital are becoming digital and in today’s times the way of business has changed and people have started the online business instead of offline – With Amazon, Flipkart, Ebay, Snapdeal etc. Through these online sites, the business has become national level rather than just a local area, So it is mandatory to register a GST, because if you want to do business from one state to another State, then GST registration is very important, without GST you will not be able to do business outside your state!

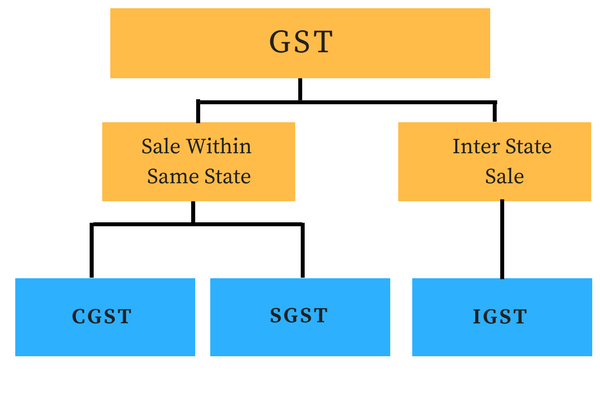

What are SGST CGST and IGST?

SGST, CGST, and IGST are part of Goods and Service Tax. CGST and SGST are charged when movement of goods and services in the same state. Examples. If a person of Delhi sells the goods to the person of Delhi, and the rate of GST on that item is 18% then 9% CGST and 9% will be SGST. And if the goods are sold to a person outside the state then IGST will be at the rate of 18%.

We are having our satisfied clients in Delhi, Faridabad, Gurgaon, Haryana, Kanpur, Lucknow, Noida, Meerut, Agra, Bareilly, Uttar Pradesh, e.t.c. PAN India

Eligibility Criteria for GST Registration

.

• The person whose annual turnover is 20 lakh or more. GST registration is mandatory for him/her. If that person does not register the GST, then he/she will be prosecuted.

• The person and the business who are doing business with the online marketplace like Amazon, Flipkart, ebay Snapdeal e.t.c. GST Registration is necessary for him/her.

• The person or business whose selling its goods and services from one state to another state then GST registration necessary. No matter his/her annual turnover is more than 20 lakh or not.

• The person and business that has already registered under the VAT or Service TAX have to migrate with GST

• If you are required to pay tax under reverse charge.

• Person supplying online information and database

• Input Service Distributor and etc.

Documents Required For GST Registration in Delhi

1. PAN Card.

2. Passport Size Photo.

3. ID Proof & Address Proof.

4. Passbook first-page copy or Cancelled Cheque.

5. Electricity Bill or Rent agreement (If you are on rent).

Our Price For Online GST Registration

.

We are offering GST Registration in Delhi just 499/- Rs only. We will not charge any extra money to our clients. We will start GST Registration process on the same day when you will provide your complete documents. You can get GST Certificate in 2 to 7 working days, It’s depending on government preparing time. Usually, It takes 3 working days to get GST Certificate.

So many people have got registered. If you are not registered yet. Take the Expert Help during the GST Registration in Delhi or Pan India Call our expert +91 9971764268 or Mail us – info@accountantfirm.in